Business Insurance in and around Seattle

One of the top small business insurance companies in Seattle, and beyond.

Insure your business, intentionally

This Coverage Is Worth It.

When you're a business owner, there's so much to remember. We get it. State Farm agent Viridiana Ramos is a business owner, too. Let Viridiana Ramos help you make sure that your business is properly covered. You won't regret it!

One of the top small business insurance companies in Seattle, and beyond.

Insure your business, intentionally

Protect Your Future With State Farm

For your small business, whether it's a home cleaning service, a bagel shop, an appliance store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, computers, and business property.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Call or email State Farm agent Viridiana Ramos's team today with any questions you may have.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

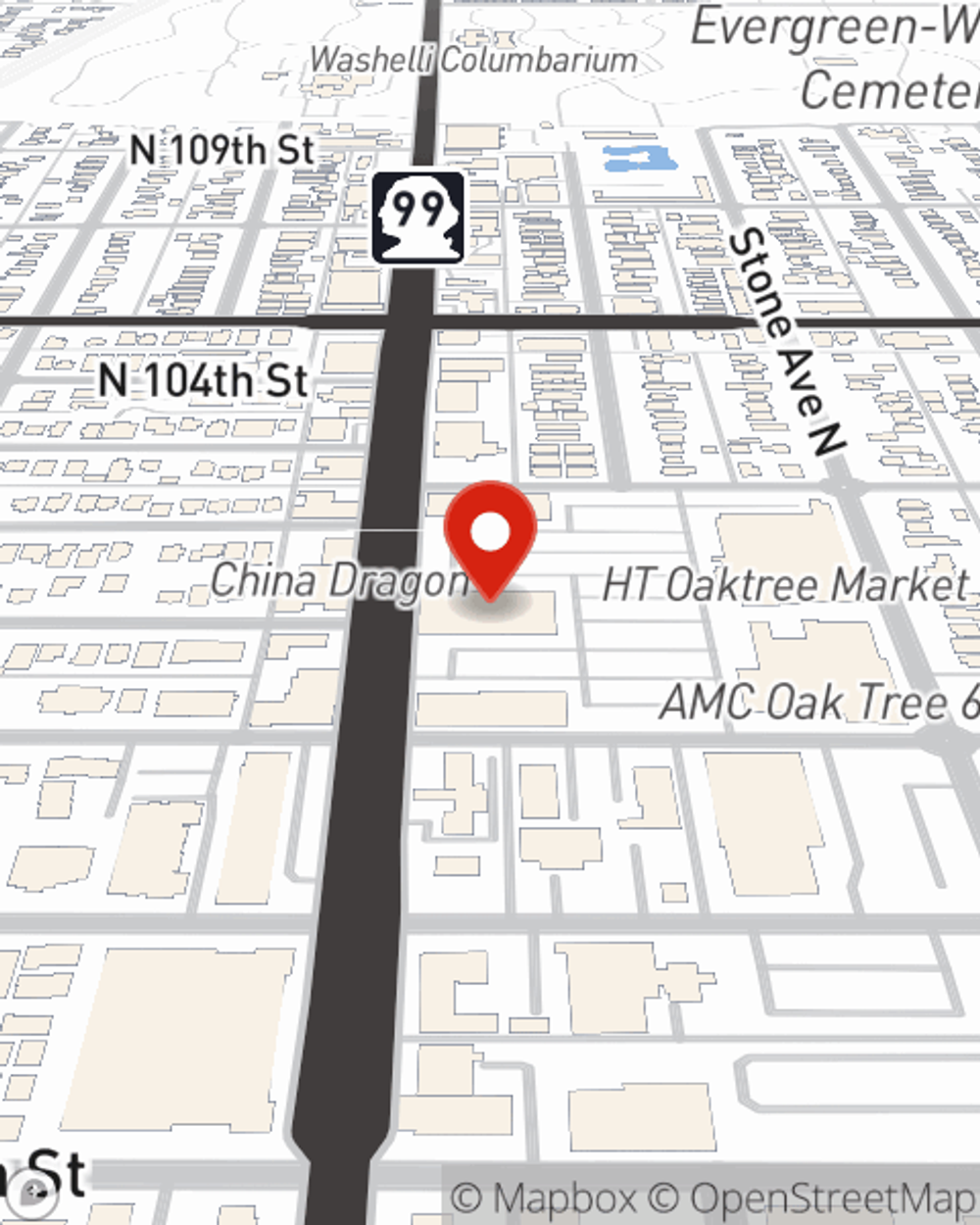

Viridiana Ramos

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.